Turn Your Credit From Stress to Strategy.

The blueprint to go from denied to approved — without begging, cosigners, or credit repair companies.

Instant Access to the Credit Toolkit $27 one-time payment – no subscriptions, no fluff. Just results.

ROOTED IN SYSTEMS TRUSTED BY THOUSANDS — NOW MADE FOR REAL ONES LIKE YOU

Ready for the Next Level?

You’ve seen what strategic credit moves can do in just 7 days.

Now imagine having a full 90-day roadmap with every play laid out, step-by-step.

That’s what the Real One’s Credit Toolkit delivers:

Clear moves

Plug-and-play templates

20+ strategies to level up — without the confusion, shame, or scammy “repair” traps

2X

More likely to increase their credit score — when using the toolkit’s methods just 30 minutes a week.

Whether you're trying to rent a home, get a better interest rate, or stop being denied, this kind of jump can change everything — fast.

50+

point boost reported by users — typically within 60–90 days

Whether you're trying to rent a home, get a better interest rate, or stop being denied, this kind of jump can change everything — fast.

$1000's

saved on car loans, credit cards, and rent — by avoiding denials and improving approval odds

Real ones are stacking savings — not just points — by qualifying for better deals and cutting high interest rates out of the picture.

20+ Proven Credit Strategies

Plug-and-play templates

Budget & Utilization Trackers

Built for real ones — no guesswork, no confusion

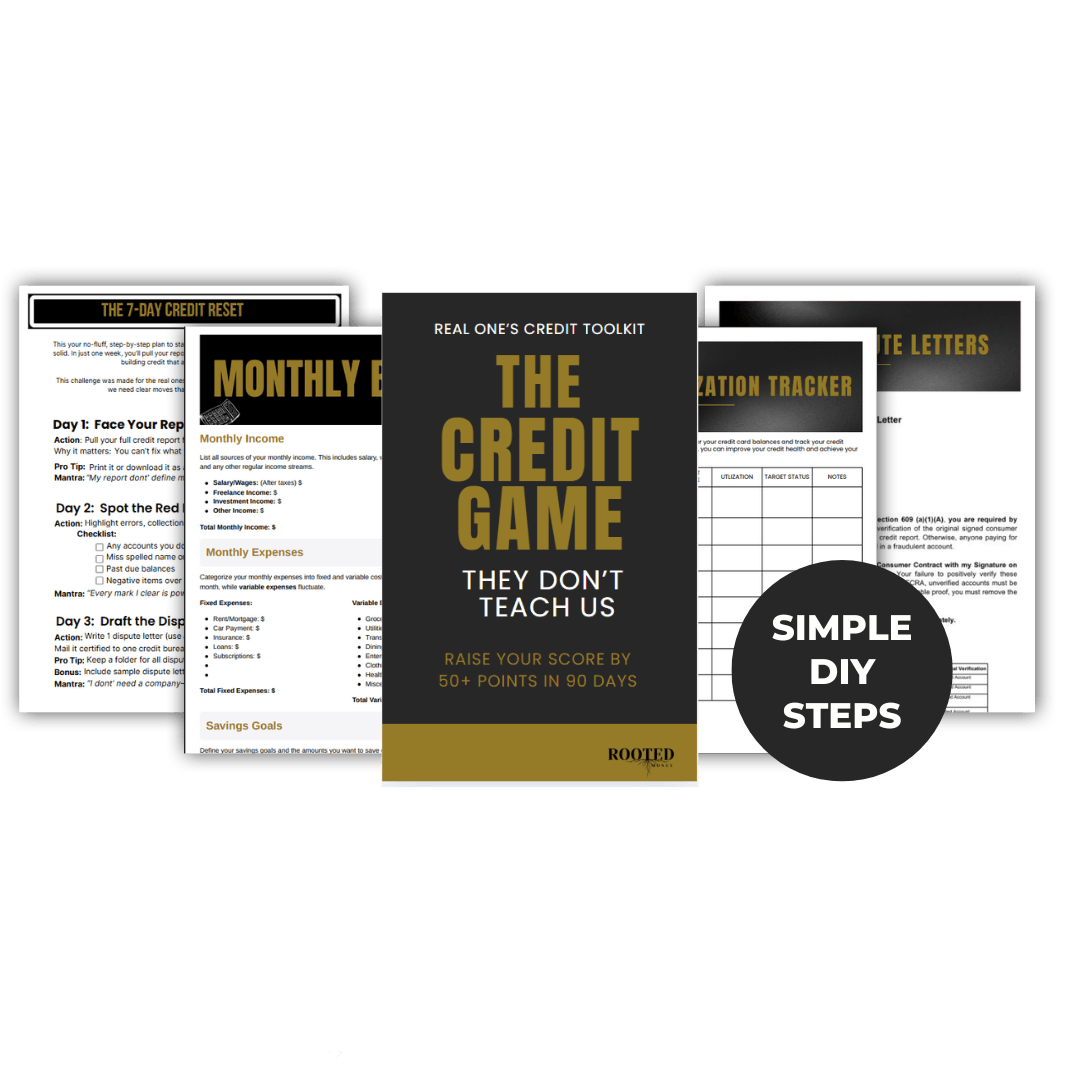

What’s Inside the Real One’s Credit Toolkit

Core Guide: The Credit Game They Don’t Teach Us

This is your blueprint — a step-by-step, no-fluff guide to understanding, fixing, and leveraging your credit like a real one. You’ll walk away with mindset shifts, clear strategies, and the exact roadmap to take your score from “stuck” to stacked.

Don’t stress over wording. These plug-and-play letters help you remove inaccurate or outdated accounts from your report — legally and confidently.

A printable and digital-friendly tracker that helps you organize your income, expenses, and payment flow so you can start saving and improving your credit.

Your usage ratio is one of the fastest things you can control. This worksheet shows you how to keep your cards in the sweet spot — under 30%, ideally 10%.

Stay on top of your progress with a simple system to track score changes, dispute results, and account status.

Explore low-risk, high-impact tools like Self, Kikoff, Ava, and Chime. These help you build a positive history, even if your score is currently low.

No guessing. Get access to a vetted list of accounts that report payment history — including AUs and vendor tradelines — to grow your credit strategically.

We Feel You. That’s Why This Toolkit Exists.

Not to shame you. But to show you the strategy — and give you the power.

You Don’t Need Perfect Credit. You Just Need a Plan.

This toolkit was built for real ones who are tired of guessing. It’s how you stop being stuck and start being strategic.

2025 Rooted Money · Intention. Power. Legacy.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

BOOK A CONSULTATION

Enter your email address below and we'll reply ASAP!